How can algorithms help you making best use of your energy assets?

Energy transition raises tough questions

The world of energy is undergoing dramatic changes on several levels. Markets have been liberalized, we have seen the rise of renewables, market mechanisms are evolving allowing demand side flexibility to be valorised, new technologies such as batteries are joining the play. The exposure of energy assets to price volatility opens new business opportunities, but also raises tough questions such as:

– When is a battery profitable?

– Does it make sense to switch from cogeneration to boilers when electricity prices are low?

– On what market should I dispatch my power plant: forward, day ahead, intraday, imbalance or a mix of it all?

It is of little use to give general answers to such questions. What we need are tools to assess the value of energy assets (batteries, powerplants, heat pumps, flexible demand, boilers …) which are exposed to markets in a specific context and business model.

Algorithms to the rescue

In essence, all of these energy assets are “arbitrage machines”,

– arbitraging over time within a same market: e.g. charge your battery at low electricity price and discharge later at a higher electricity price; or

– arbitraging between markets: between forward and day ahead electricity markets, between gas and electricity market etc.

The energy system of an industrial plant is often combining different energy assets to produce or consume different energy vectors: heat, cold, gas, electricity, hydrogen, … So, what is the best use of these assets, in other words “how to dispatch your energy assets economically”?

The complexity of these questions is hard to grasp in a straightforward spreadsheet. Luckily, algorithms can help. Nowadays, data science has become sufficiently accessible and offers good forecasting and optimization algorithms to help us tackling these questions.

Economic dispatch tool for energy assets in practice

Off course, some expertise is still required to understand the problem and define the business model.

Secondly, we define a cost (or revenue) function which sums it all up and we feed this cost function to an optimization algorithm. There are boundary conditions imposed to the algorithm: technical limits, operational limits, start up costs, redundancy requirements etc.

Most of the problems also need some sort of forecasting of some parameters: forecasting of energy demand, forecasting of energy prices. Again we can use existing algorithms which we customize by feeding them with the right data.

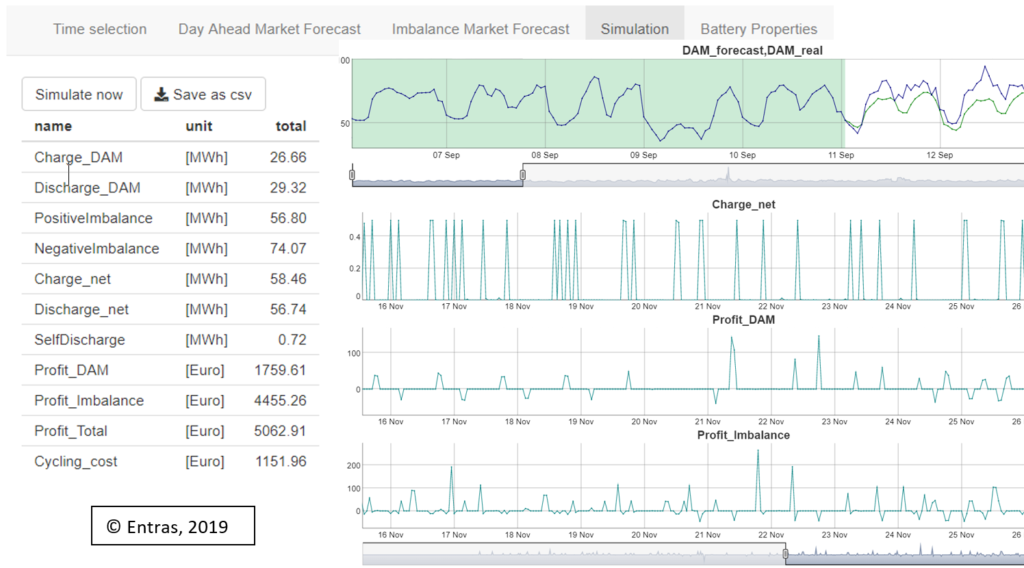

Below you can find an example of the concrete application of such a tool for a battery exposed to the day ahead market and subsequently optimizing its revenue on the imbalance market over a period of a month in November 2018 in Belgium.

This approach is not limited to batteries and can be applied to all energy assets. At Entras, we have also applied it to dispatch CCGT powerplants or to find the best business model for power-to-X applications.

The approach can be applied for different purposes

– design: e.g. what is the optimal ratio of convertor power vs battery capacity;

– project development: e.g. what cash flow can be generated by the assets;

– real time dispatching: e.g. when shall I charge and discharge my battery.