Opportunities in the EU energy crisis – part 3

In our previous blog post we teased with opportunities in the EU energy crisis. Haven’t read it yet? Take a look here. Otherwise, enjoy this post on load shifting with flexible assets!

Load shifting with flexible assets

A keyword in the energy transition is flexibility. It should by now be generally accepted that we cannot go without and that it will be the cheapest sources who will supply it. But flexibility is a broad concept and ranges in time from seconds to seasons and covers both power and energy.

Each asset has its specific characteristics and could be controlled in a dedicated manner. One of these flexibility control options is the shifting of load in time. And the price incentive to do so can come from the wholesale electricity market.

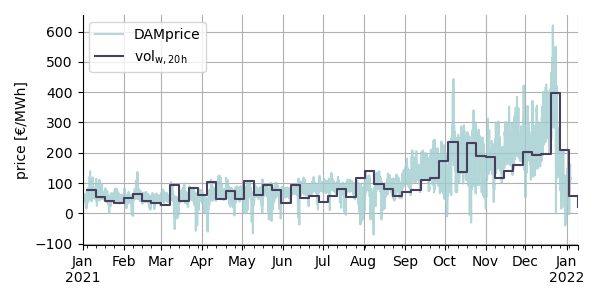

Enter the day-ahead market price volatility as measure of load shifting incentive. With the volatility being a temporal price difference, a high volatility corresponds with a high incentive for load shifting. As each asset has different abilities to shift load, no single overarching volatility index can be defined. Here the vol20 is defined as the absolute price difference between the average of the 20 most expensive hours and the average of the 20 least expensive hours within a single week. It is applicable to assets with weekly production schedules such as commercial electrolysers.

The figure above shows this vol20. It is clear that not only the average electricity price has seen a large upsurge, but that also the volatility has increased. This is due to the fact that during moments with low renewables and high demand, fossil fuel power plants need to step up, burning increasingly expensive coal or gas. During moments with low demand and/or high renewables output, prices remain low as they are not influenced by fossil fuel prices. As a result, large price differences occur between moments, hence a high volatility is seen.

To flex or not to flex, that is (not) the question

Learn more on the concept of design for flexibility and why we believe it will have its role in the energy transition

Supply and demand of flexibility

Learn more on the concept of supply and demand of flexibility and where Entras is positioned.

Webinar Belgium as a hydrogen importhub

Read more about: Belgium as a hydrogen importhub – Roadmap towards 2030 and beyond

IEA Energy Policy Review for Belgium

The IEA Energy Policy Review for Belgium has been updated! At ENTRAS we fully support the findings.

Opportunities in the EU energy crisis – Part 2

Read more on arbitrage with multi-energy systems in this 2nd post on the opportunities in the EU energy crisis.

Opportunities in the EU energy crisis – Part 1

Read more on valorisation of flexible assets and arbitrage with multi-energy systems in our upcoming blog posts.

Shipping sun and wind to Belgium

Importing renewable energy and balancing the grid by power-to-X applications will be essential elements of the energy transition.

Passionate about energy & data science? Entras is hiring!

As Data Scientist, you are a key member of our project team. You will participate in every phase of the project development …

The value of flexibility in times of change

What lessons can CHP owners learn from the first four months of 2020? Looking back at the electricity market in Belgium we …

How can algorithms help you making best use of your energy assets?

How can algorithms help you making best use of your energy assets?